Comunicado de Prensa

Discovery Reports Measured & Indicated Resource of 910 Moz AgEq and Inferred Resource of 140Moz AgEq for Cordero

A video presentation that accompanies this release can be found at:

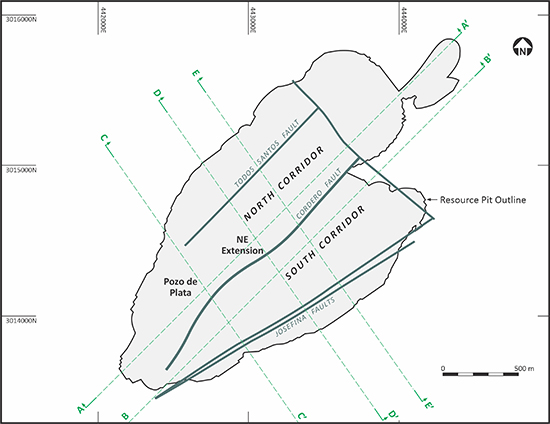

October 20, 2021, Toronto, Ontario - Discovery Silver Corp. (TSX-V: DSV, OTCQX: DSVSF) ("Discovery" or the "Company") is pleased to announce an updated Mineral Resource Estimate ("Resource") on its flagship Cordero silver project ("Cordero" or "the Project") located in Chihuahua State, Mexico. The Resource is pit-constrained with an estimated waste-to-ore ratio of 1.1 and is supported by 224,000 m of drilling in 517 drill holes and reinterpreted structural and geological models of the deposit. 87% of the contained metal is in the Measured and Indicated category. The Resource will be used to support an updated PEA scheduled for completion later this quarter. The size of the Resource positions Cordero as one of the largest development-stage silver projects globally. Highlights include:

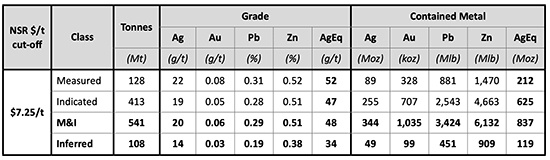

SULPHIDE RESOURCE (assumed to be processed via mill/flotation)

- Measured & Indicated Resource of 837 Moz AgEq1 at an average grade of 48 g/t AgEq1 (541 Mt grading 20 g/t Ag, 0.06 g/t Au, 0.29% Pb and 0.51% Zn)

- Inferred Resource of 119 Moz AgEq1 at an average grade of 34 g/t AgEq1 (108 Mt grading 14 g/t Ag, 0.03 g/t Au, 0.19% Pb and 0.38% Zn)

- High-grade subset – at a $25/t NSR cut-off a Measured & Indicated Resource of 509 Moz AgEq1 at an average grade of 101 g/t AgEq1 (42 g/t Ag, 0.11 g/t Au, 0.64% Pb and 1.04% Zn)

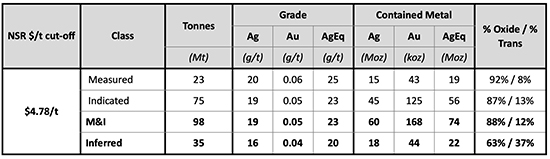

OXIDE/TRANSITION RESOURCE (assumed to be processed by heap leaching)

- Measured & Indicated resource of 74 Moz AgEq1 at an average grade of 23 g/t AgEq1 (98 Mt grading 19 g/t Ag and 0.05 g/t Au)

- Inferred Resource of 22 Moz AgEq1 at an average grade of 20 g/t AgEq1 (35Mt grading 16 g/t Ag and 0.04 g/t Au)

- High-grade subset – at a $15/t NSR cut-off, a Measured & Indicated Resource of 26 Moz AgEq1 at an average grade of 60 g/t AgEq1 (52 g/t Ag and 0.09 g/t Au)

Taj Singh, President and CEO, states: "This resource estimate represents a huge step forward in advancing Cordero for two key reasons. First, close to 90% of the contained metal is in the Measured and Indicated category. This achievement is reflective of the tight drill spacing supporting the resource along with the continuity of mineralization within each estimation domain. Second, the resource demonstrates the large volume of higher-grade mineralization within the deposit. This, along with the low strip ratio, excellent metallurgy and adjacent infrastructure, provide a strong platform as we pursue our target of outlining an average production rate of at least 15 Moz of AgEq per year for a minimum of 15 years with cash costs in the lowest half of the industry cost curve in our PEA later this quarter. Finally, we would also like to acknowledge the excellent work of our Mexican team in managing our sizeable drill program to deliver this very large and technically-robust resource."

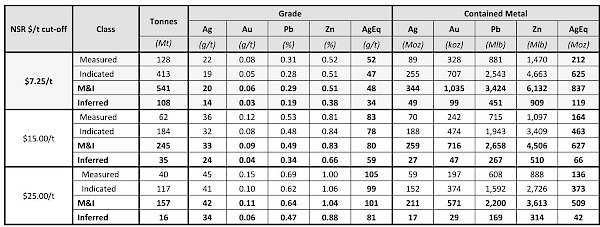

SULPHIDE RESOURCE:

Sulphide mineralization is categorized as all mineralization that sits beneath the oxide/transition boundary and is assumed to be processed via standard flotation processing. Sulphide mineralization extends to depths of more than 800 m below surface. The estimates in the below table sit within a pit shell that extends to a maximum depth of approximately 600 m.

The Sulphide Resource as outlined in the table below assumed a $7.25/t Net Smelter Return ("NSR") cut-off (see Resource Estimate Summary section below).

1. Please refer to the Supporting Technical Disclosure section for cautionary statements and underlying assumptions for the Resource.

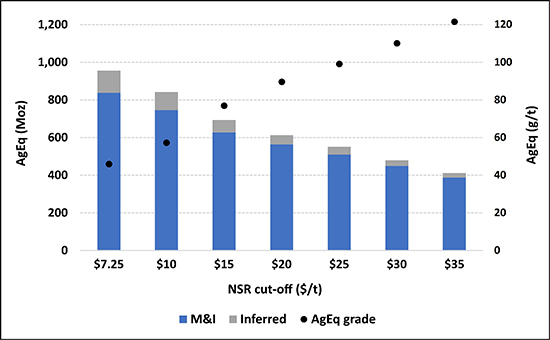

Sulphide Resource Estimate – NSR Cut-off Sensitivity

A significant portion of the Sulphide Resource persists at higher NSR cut-offs as highlighted in the graph below. At an NSR cut-off $25/oz, the Measured & Indicated Resource is 509 Moz AgEq1 at an average grade of 101 g/t AgEq1 representing over 60% of the total Measured and Indicated Sulphide Resource.

Note – NSR cut-off of $7.25/t is the reporting cut-off for Sulphide mineralization

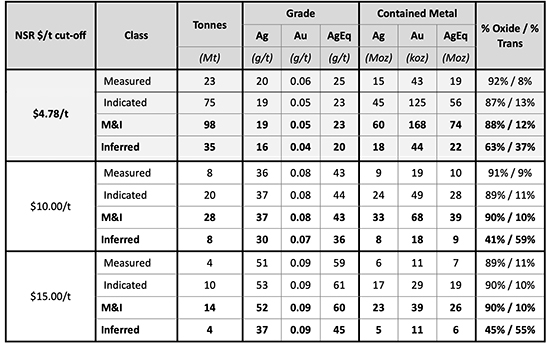

OXIDE/TRANSITION RESOURCE:

Oxide/transition mineralization is categorised as all mineralization that is at or close to surface that is weathered (oxide) or partially weathered (transition). Oxide/transition mineralization is assumed to be processed via heap leaching. Lead and zinc are not incorporated in the Oxide/Transition Resource given these metals are not recoverable through heap leaching. The depth of the oxide/transition zone varies across the deposit from approximately 20 m in the Pozo de Plata zone to depths of up to 100 m in certain areas in the South Corridor and in the far north-east of the deposit.

The Oxide/Transition Resource as outlined in the table below assumed a $4.78/t NSR cut-off (see Resource Estimate Summary section below).

1. Please refer to the Supporting Technical Disclosure section for cautionary statements and underlying assumptions for the Resource

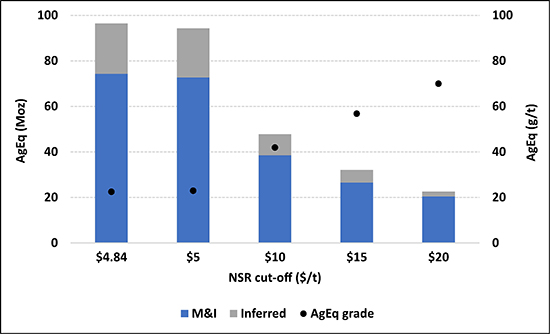

Oxide/Transition Resource Estimate – NSR Cut-off Sensitivity

A graph showing sensitivities to the NSR cut-off is also provided below. At a $15 NSR cut-off the Oxide/Transition Measured & Indicated Resource is 26 Moz AgEq1 averaging 60 g/t AgEq1 highlighting the excellent potential to generate meaningful cash flow via heap leaching in the early years of the mine life.

Note – NSR cut-off of $4.84/t is the reporting cut-off for Oxide/Transition mineralization

RESOURCE SUMMARY:

Resource estimation:

- The Resource was compiled by Rock Ridge Consulting Resource Geologists. Mo Srivastava of Red Dot 3D was retained to complete an independent third-party review of the Resource estimation methodology.

- Supporting drill dataset consists of 224,000 m of drilling (517 drill holes); of this drilling 92,000 m of drilling (225 drill holes) was completed by the Company.

- The Resource incorporates geological and structural constraints and is an in-pit resource containing a total of 782 Mt of Mineral Resource and 893 Mt of waste.

Net Smelter Return (NSR) cut-off:

- NSR is defined as the net revenue from metal sales (taking in to account metallurgical recoveries and payabilities) less treatment costs and refining charges.

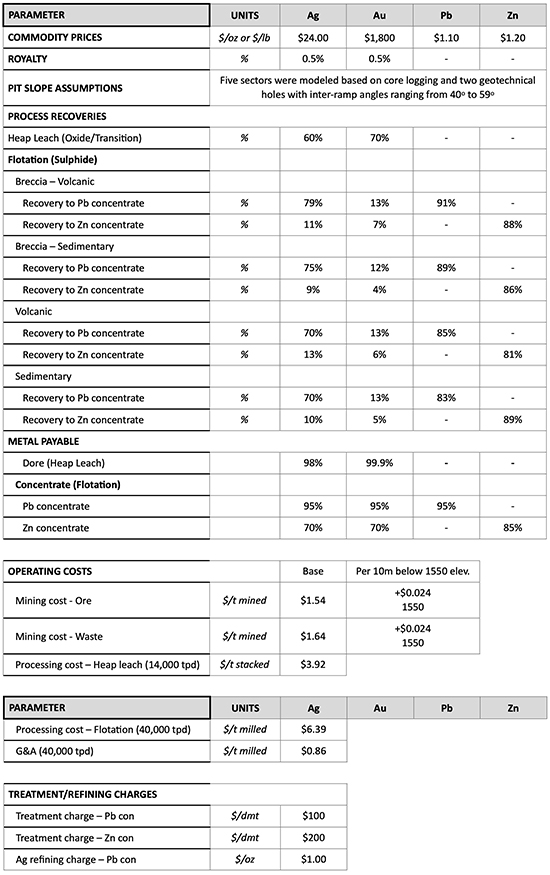

- Sulphide mineral resources are reported at a $7.25/t NSR cut-off based on the estimated processing and G&A cost for sulphide mineralization.

- Oxide/transition mineral resources are reported at a $4.78/t NSR cut-off based on the estimated processing and G&A cost for oxide/transition mineralization.

Pit constraint & NSR calculation assumptions:

- Key assumptions are outlined directly below (the full list of assumptions can be found in the Appendix):

- Commodity prices: Ag - $24.00/oz, Au - $1,800/oz, Pb - $1.10/lb, Zn - $1.20/lb.

- Metallurgical recoveries: sourced from the Company's 2021 test program - sulphides were based on locked cycle test work and oxides/transition was based on coarse bottle roll test work.

- Operating costs:

- Base mining costs of $1.54/t for ore and $1.64/t for waste (with incremental costs of $0.024/t per 10 m bench below the 1550 elevation) were developed by AGP Mining Consultants Inc.

- Processing costs of $6.39/t for mill/flotation and $3.92/t for heap leaching and G&A costs of $0.86/t were developed by Ausenco Engineering Canada Inc.

- Pit slopes: pit slope assumptions were based on a pit slope assessment completed by Knight Piésold and Co. (USA).

- Commodity price assumptions were guided by the NI 43-101 requirement for the Resource to have 'reasonable prospects' of economic extraction. The Company plans to use a more conservative price deck for the PEA.

Growth Opportunities:

- Bulk-tonnage targets: follow up drilling of historic holes that returned encouraging intercepts in the far north-east of the deposit within Domain 6 (see Estimation Domains below).

- High-grade vein targets: future drilling to test extensions along strike and at depth at Todos Santos and along strike to the north-east of the Josefina vein trend.

SUPPORTING TECHNICAL DISCLOSURE:

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- AgEq for the Sulphide Resource is calculated as Ag + (Au x 16.07) + (Pb x 32.55) + (Zn x 35.10); these factors are based on commodity prices of Ag - $24.00/oz, Au - $1,800/oz, Pb - $1.10/lb, Zn - $1.20/lb and assumed recoveries of Ag – 84%, Au – 18%, Pb – 87% and Zn – 88%.

- AgEq for the Oxide/Transition Resource is calculated as Ag + (Au x 87.5); this factor is based on commodity prices of Ag - $24.00/oz and Au - $1,800/oz and assumed recoveries of Ag – 60% and Au – 70%.

- The Resource is constrained by a pit optimisation; supporting parameters for this pit constraint are provided in the Pit Constraint Parameters section in the Appendix below.

- Individual metals are reported at 100% of in-situ grade.

- Sensitivity cut-offs reported are a subset of the in-pit Resource.

- The effective date of the Resource is October 20, 2021, and is based on drilling through July 2021.

- All figures are in US dollars unless otherwise noted.

- There are no known legal, political, environmental or other risks that could materially affect the potential development of the Resource.

- A full technical report will be prepared in accordance with NI 43-101 and will be filed on SEDAR within 45 days of this press release.

APPENDIX:

An appendix with the following supporting information can be found at the end of the release or the following link: Appendix

- Resource Estimation Methodology

- Estimation Domains

- Variability & Capping

- Pit Constraint Parameters

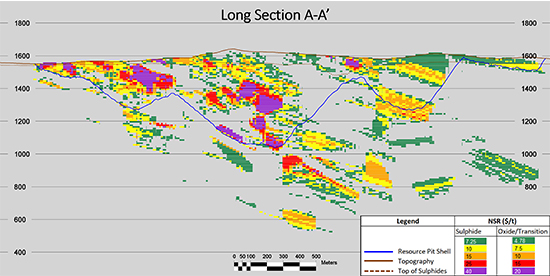

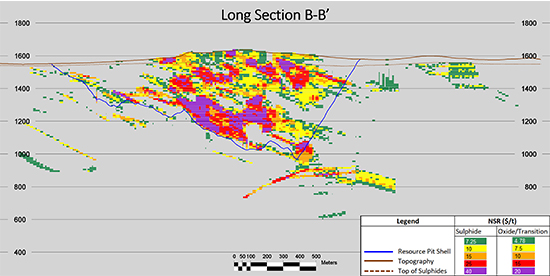

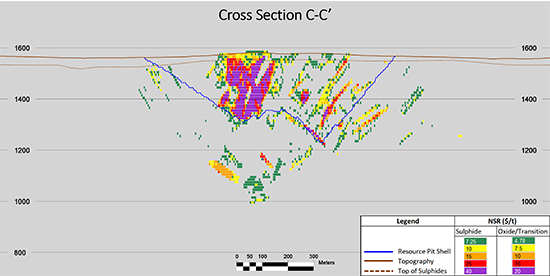

- Long Sections / Cross Sections

- Resource NSR Cut-off Tables

About Discovery

Discovery's flagship project is its 100%-owned Cordero project, one of the few silver projects globally that offers margin, size and scaleability. Cordero is located close to infrastructure in a prolific mining belt in Chihuahua State, Mexico, and is supported by an industry leading balance sheet with over C$75 million available for aggressive exploration, resource expansion and future development. Discovery was a recipient of the 2020 TSX Venture 50 award and the 2021 OTCQX Best 50 award.

On Behalf of the Board of Directors,

Taj Singh, M.Eng, P.Eng, CPA,

President, Chief Executive Officer and Director

For further information contact:

Forbes Gemmell, CFA

VP Corporate Development & Investor Relations

Phone: 416-613-9410

Email: forbes.gemmell@discoverysilver.com

Website: www.discoverysilver.com

Qualified Person

The scientific and technical content of this press release was reviewed and approved by R. Mohan Srivastava who is a "Qualified Person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). Mr. Srivastava is a consultant to Red Dot 3D, a geological consulting company specializing in mineral resource estimation, and is considered to be "independent" of Discovery for purposes of section 1.5 of NI 43-101.

FORWARD-LOOKING STATEMENTS:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release is not for distribution to United States newswire services or for dissemination in the United States.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

Cautionary Note Regarding Forward-Looking Statements

This news release may include forward-looking statements that are subject to inherent risks and uncertainties. All statements within this news release, other than statements of historical fact, are to be considered forward looking. Although Discovery believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those described in forward-looking statements. Factors that could cause actual results to differ materially from those described in forward-looking statements include fluctuations in market prices, including metal prices, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. Discovery does not assume any obligation to update any forward-looking statements except as required under applicable laws.

APPENDIX

RESOURCE ESTIMATION METHODOLOGY:

Resource database: The resource database consists of a total of 224,148 m of sampling in 517 drill holes. Of the total holes in the database 221,839m of sampling from 478 holes are included in the Resource. A total of 91,713 m (225 drill holes) was completed by the Company with the remainder drilled historically between 2009 and 2017. Lithologic types logged in 195,553 m of drill core were used to support an updated geological model of the deposit.

Compositing: The Cordero drill core was predominantly sampled at an interval of 2m or less. Assay records were assigned a domain code and then composited to approximately 2m intervals. The composite interval was varied where required to avoid excessively short composites from forming at domain boundaries or at the ends of holes.

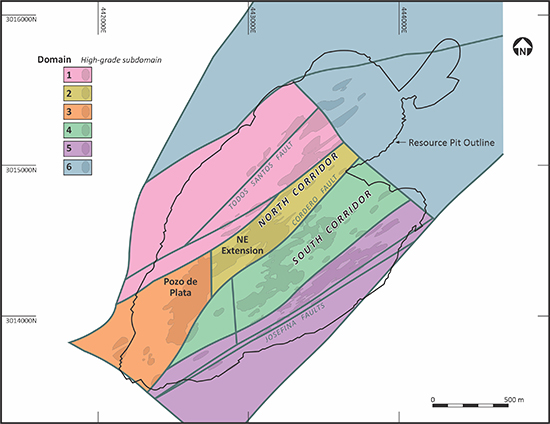

Estimation domains: Six estimation domains were created, bounded by major faults. Within each of these six domains, there are two sub-domains; a high-grade sub-domain and a medium to low-grade stockwork domain. An additional sub-domain representing a mostly barren, glomerophyric dyke was also modeled. Hard boundaries for the block model were then applied to these thirteen estimation sub-domains. A graphic representation of the estimation domains is provided in the plan map below.

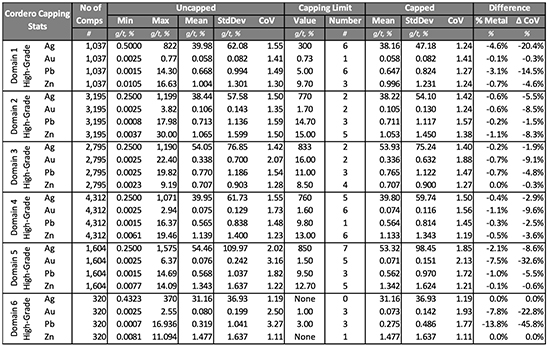

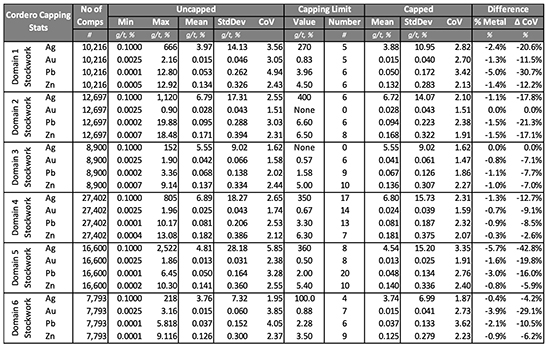

Capping: The presence of high-grade outlier values was investigated, as these low probability values could adversely influence the estimate. In all estimation domains and for all elements, the locations of the high-grade outliers were not concentrated in a given area, but rather disseminated throughout each domain. Appropriate capping limits were selected by studying coefficient of variation plots, probability plots and decile plots. The capping applied to the composite dataset resulted in a reduction in total silver content of 1.6% and a reduction in total metal content (Ag-Au-Pb-Zn) of 1.8%. Additional geostatistics summarizing variability and capping for each sub-domain is provided in the table below.

Variography & interpolation: Experimental pairwise relative semi-variograms were calculated and modeled for each metal in each mineralized domain. Spherical two structure models were fitted to all experimental semi-variograms. All the domains had sufficient samples to create acceptable experimental semi-variograms for each metal. Strong anisotropy was observed for the most part and thus directional variogram models were used. Nugget values (i.e., the sample variability at close distance) were established from downhole variograms. Nugget values were on average approximately 33% of the total sill value for all elements in all domains. Major axis ranges for the short first structure of all the variograms were approximately 25 m and the ranges for the second structure were 115 m on average. Anisotropic search radii with variable orientations along mineralization trends were used to select data informing block estimates. Search radii were based on the variogram ranges. Ordinary kriging was used to estimate all blocks into the model in three estimation passes.

Block model: The block model was constructed to fill the domain volumes with 20 m x 5 m x 10 m in the X, Y and Z directions rotated to an azimuth of 55⁰ to best represent: the data density; the narrower, steeply dipping deposit shape; and to minimize blocks unsupported by data. Accurate representation of the domain volume was achieved by allowing sub-blocks to be created at domain boundaries. Each parent cell could be split in the X, Y and Z directions. For both sets of parent cell sizes described above, blocks in the X and Y directions were split, with a minimum possible size of 2.5 m, while the height of the block was truncated precisely against the wireframe boundary. Each sub-block was assigned the estimate derived for the parent block.

Classification: The block model was classified into Measured, Indicated and Inferred resource categories. Blocks were assigned a preliminary classification based on the variography, drillhole spacing and number of samples in each pass as well as by domain. Search distances for the first pass were half the variogram range; this was used as the initial classification for assigning blocks to the Measured resource category. Blocks estimated in the second pass employed a search distance of the full variogram range and were allocated to the Indicated resource category. Blocks estimated in the third pass that allowed a relaxed search up to three times the range were assigned to the Inferred resource category. The preliminary classification boundaries were then adjusted to create continuity of blocks within the corresponding resource category classification.

Overburden/Weathering profile: Drill logs differentiating the weathered near-surface material from the un-weathered underlying rock, as well as a transition zone, were used to model surfaces for oxide, transitional and fresh material. These surfaces were included in the model to estimate density values as well as code blocks into each category. An overburden volume was also modeled from the drill logs. The bottom of the overburden surface was used to truncate grade estimates.

Bulk density: Density values were available from metallurgical test work for rhyodacite, siltstone and two breccia samples. No measurements were taken for the dyke and hornfels lithotypes. A total of 1501 bulk density measurements were collected from pulps for the oxide zone, 355 measurements for the transition zone and 5244 pulp measurements for fresh rock, so a large dataset of pulp density exists. Densities were calculated by factoring the differences between the pulp density measurement into the metallurgical sample values for rhyodacite and siltstone. The resulting values were assigned to dyke and hornfels lithotypes respectively. An average density value was assigned to each of the six modeled lithotypes. Density values for the oxide and transitional portions of each lithotype was factored down by an additional 4% and applied to the oxide blocks.

ESTIMATION DOMAINS

VARIABILITY & CAPPING – HIGH-GRADE SUB-DOMAINS

VARIABILITY & CAPPING – STOCKWORK SUB-DOMAINS

PIT CONSTRAINT PARAMETERS:

The mineral resource is constrained by a pit optimization that was based on the following parameters:

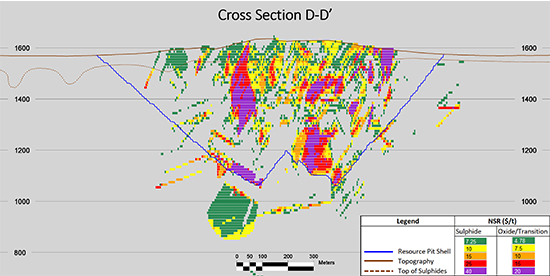

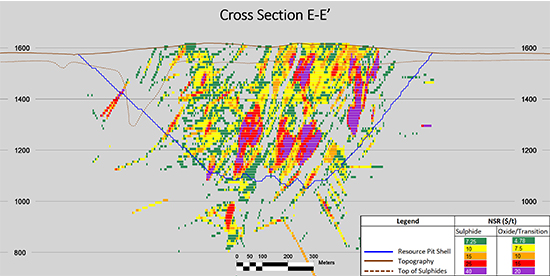

LONG SECTIONS / CROSS SECTIONS:

Long Section A-A'

Long Section B-B'

Cross Section C-C'

Cross Section D-D'

Cross Section E-E'

RESOURCE NSR CUT-OFF SENSITIVITIES:

Sulphide Resource

- Please refer to the Supporting Technical Disclosure section for cautionary statements and underlying assumptions for the Resource

Oxide/Transition Resource

- Please refer to the Supporting Technical Disclosure section for cautionary statements and underlying assumptions for the Resource