Comunicado de Prensa

Discovery Reports Exceptional Results from its Pre-Feasibility Study Metallurgical Test Program

August 29, 2022, Toronto, Ontario - Discovery Silver Corp. (TSX-V: DSV, OTCQX: DSVSF) (“Discovery” or the “Company”) is pleased to announce results from its Pre-Feasibility Study (“PFS”) metallurgical test program on representative samples from its Cordero project (“Cordero” or “the Project”) located in Chihuahua State, Mexico. This program represents the most comprehensive test work completed on Cordero to date. Highlights from the locked-cycle flotation test work include:

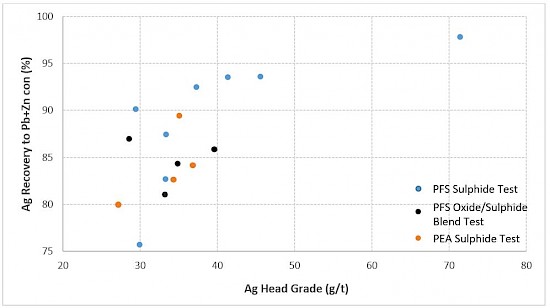

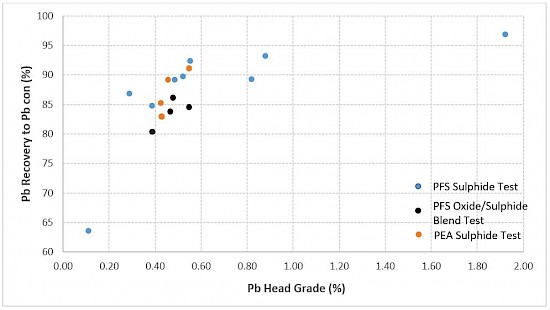

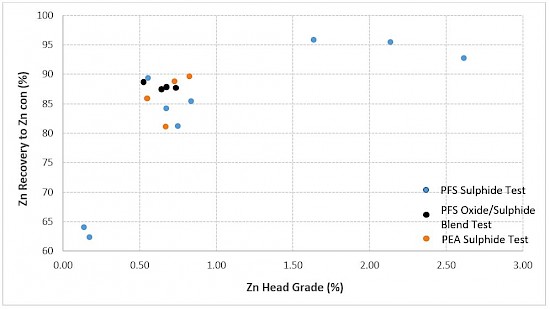

- Silver recoveries of 94-98%, lead recoveries of 89-97% and zinc recoveries of 92-96% on high grade samples of all major rock types.

- Silver recoveries of 83-92%, lead recoveries of 85-92% and zinc recoveries of 81-89% on medium grade samples of blended rock types.

- Oxide-sulphide blend testwork establish oxide-specific recoveries of ~60% for silver, ~40% for lead and ~85% for zinc via flotation; co-processing oxide mineralized material via flotation eliminates the need for heap leach processing at Cordero.

- Test work overall confirmed higher recoveries than what was assumed in the 2021 Preliminary Economic Assessment (“PEA”).

- All tests were completed at a coarse grind size of p80 passing ~210 micron and demonstrated significantly lower reagent consumption than assumed in the PEA.

- Saleable concentrate grades confirmed and levels of penalty elements for concentrates were insignificant.

Tony Makuch, Interim CEO, states: “Our PFS metallurgical test results demonstrate the exceptional metallurgical properties of our Cordero deposit. Recoveries typically ranged from 85-95% at an extremely coarse grind size of ~210 micron. On average recoveries came in higher than what was assumed in our PEA and were achieved at significantly reduced reagent consumption highlighting the potential for reduced operating costs for our PFS.

“In addition, our first ever flotation testwork of an oxide-sulphide blend returned very positive results with economic recoveries for oxide mineralization for silver, lead and zinc through flotation. These results allow for the elimination of the heap leach circuit in our PFS; this will streamline the crushing/grinding circuit, reduce upfront capital expenditures and simplify the permitting process.”

PFS METALLURGICAL TEST PROGRAM

Summary: the PFS metallurgical test program was designed to supplement the detailed metallurgical test program completed in 2021 and included the Company’s first ever testing of rock type blends, high-grade samples (+100 g/t AgEq) and oxide-sulphide blends. Test work was also focused on optimizing reagent usage. All test work was completed at a coarse grind size of ~210 micron.

Results from the 14 locked cycle tests are summarized in the table below. Recoveries from these tests were higher than the recoveries assumed in the 2021 PEA and were achieved at lower reagent consumptions. Further details including recoveries broken out by concentrate type and head grade vs recovery plots for both our PEA and PFS metallurgical test programs can be found in the appendices. The testwork was conducted by Blue Coast Research Ltd. (“Blue Coast”), an independent third party, with oversight from Libertas Metallurgy Ltd. (“Libertas”) and Ausenco Engineering Canada Inc. (“Ausenco”).

| Test Type | Rock Type / Sample Location | Head Grade | Lead + Zinc Circuit | |||||

| Recovery to Concentrate | ||||||||

| Ag | Pb | Zn | AgEq | Ag | Pb | Zn | ||

| (g/t) | (%) | (%) | (g/t) | (%) | (%) | (%) | ||

| High-Grade | Breccia | 252 | 3.8 | 2.6 | 462 | 97 | 96 | 93 |

| Volcanic | 71 | 1.9 | 5.1 | 319 | 98 | 97 | 92 | |

| Volcanic | 46 | 0.9 | 2.1 | 151 | 94 | 93 | 96 | |

| Sedimentary | 41 | 0.8 | 1.6 | 128 | 94 | 89 | 93 | |

| Rock Type Blend | Starter Pit | 37 | 0.6 | 0.6 | 76 | 92 | 92 | 89 |

| NE Extension | 29 | 0.5 | 0.7 | 70 | 90 | 90 | 84 | |

| South Corridor | 33 | 0.4 | 0.8 | 76 | 83 | 85 | 85 | |

| Run of Mine | 33 | 0.5 | 0.8 | 76 | 87 | 89 | 81 | |

| Low-Grade | Volcanic | 10 | 0.1 | 0.2 | 21 | 43 | 64 | 62 |

| Breccia | 30 | 0.3 | 0.1 | 44 | 76 | 87 | 64 | |

| 10% Oxide / 90% Sulphide Blend | Starter Pit | 40 | 0.5 | 0.5 | 76 | 86 | 84 | 89 |

| NE Extension | 29 | 0.5 | 0.6 | 66 | 87 | 86 | 88 | |

| South Corridor | 33 | 0.4 | 0.7 | 71 | 81 | 80 | 88 | |

| Run of Mine | 35 | 0.5 | 0.7 | 74 | 84 | 84 | 88 | |

High-grade samples: four locked cycle tests were completed on high-grade samples (+100 g/t AgEq) of the major rock types. Recoveries averaged 95% for silver, 94% for lead and 94% for zinc. These recoveries were on average approximately 7% higher than the recoveries for the medium-grade samples (50-100 g/t AgEq) confirming a positive relationship between head grade and recovery.

Rock type blends: four locked cycle tests were completed on a blend of the major rock types at Cordero (volcanic, breccia & sedimentary rocks). The blend ratios were based on the expected proportions of mill feed from different parts of the deposit. Three of the four tests returned higher than expected recoveries confirming the potential for positive synergies through blending of the different rock types. Further testwork will be completed on understanding and quantifying these synergies in more detail as part of the Company’s feasibility study test program.

Oxide-sulphide blends: four locked cycle tests of oxide-sulphide blends (~10% oxides / ~90% sulphides) returned implied average recoveries for oxide mineralization through flotation of approximately 60% for Ag, 40% for Pb and 85% for Zn. These recoveries can most likely be attributed to the presence of sulphide mineralization (galena and sphalerite) in the oxide layer as identified by preliminary mineralogical analysis.

Based on these results the PFS will assume blending of oxides with sulphides in the flotation circuit. This is a very positive development as it will reduce upfront capital expenditures through the complete elimination of the heap leach circuit as well as simplify the process design through reducing the crushing circuit from three stages to a single stage. It is also expected to streamline the permitting process as it eliminates the use of cyanide at the Project.

Comminution:

The below comminution testwork was completed as part of the PFS test program. Results were mostly consistent with the comminution results from the PEA test program.

- Bond ball work index (BWI) ranged from 14.3 to 23.1 kWh/tonne across 33 samples with an overall average of 19.0 kWh/tonne (metric)

- Bond rod mill grindability (RWI) ranged from 12.6 to 16.0 kWh/tonne across ten samples with an overall average of 14.4 kWh/tonne (metric)

- Bond abrasion index (Ai) ranged from 0.17 to 0.97 g across ten samples with an overall average of 0.57 g

Concentrate analysis:

Saleable concentrate grades for both lead (>40% lead and >1,500 g/t silver) and zinc (>50% zinc) concentrates were readily achieved while the level of penalty elements was low (see table directly below) confirming excellent saleability of both concentrates.

| Element | Median Grade1 | Penalty Threshold2 |

|

Lead Concentrate: |

||

| As | 0.31% | 0.50% |

| Sb | 0.43% | 0.50% |

| Hg | 12 ppm | 100 ppm |

| Cl+F | 200 ppm | 500 ppm |

|

Zinc Concentrate: |

||

| As | 0.14% | 0.30% |

| Fe | 7.00% | 8.00% |

| Cd | 0.50% | 0.30% |

| SiO2 | 3.15% | 3.50% |

| Hg | 15 ppm | 100 ppm |

| Cl+F | 300 ppm | 500 ppm |

| Mn | 0.95% | 0.50% |

1Median grade was calculated as the median of the concentrates from the 14 locked cycle tests in the PFS test program and the four locked cycle tests from the PEA test program

2 Penalty thresholds vary between smelters; the thresholds listed above are representative of common thresholds typically applied on lead and zinc concentrates

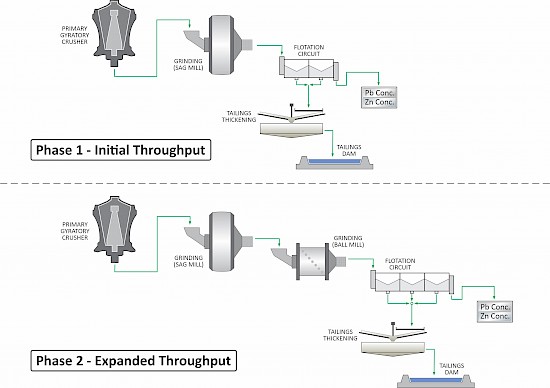

PROCESS DESIGN

The process design for the PFS will incorporate staged expansions. The first phase will incorporate single stage semi-autogenous (“SAG”) milling consisting of a single primary gyratory crusher, single SAG mill and flotation circuit. This configuration is a common design with the advantages of being capital efficient and providing expansion flexibility. The planned throughput rate of this initial phase is expected to be approximately 25,000 tonnes per day (“tpd”).

The second phase of the mill expansion will include the addition of a ball mill and parallel flotation circuit. The planned throughput rate of this expanded phase is expected to be approximately 50,000 tpd.

The proposed process design for the PFS is much simpler and significantly more streamlined in comparison to the process design assumed in the PEA with the elimination of the heap leach circuit and the secondary and tertiary crushing circuits. A proposed flowsheet of the updated process design can be found in Figure D in the appendices.

About Discovery

Discovery’s flagship project is its 100%-owned Cordero project, one of the world’s largest silver deposits. The PEA completed in November 2021 demonstrates that Cordero has the potential to be developed into a highly capital efficient mine that offers the combination of margin, size and scalability. Cordero is located close to infrastructure in a prolific mining belt in Chihuahua State, Mexico. Continued exploration and project development at Cordero is supported by a strong balance sheet with cash of approximately C$60 million.

On Behalf of the Board of Directors,

Tony Makuch

Interim Chief Executive Officer and Director

For further information contact:

Forbes Gemmell, CFA

VP Corporate Development

Phone: 416-613-9410

Email: forbes.gemmell@discoverysilver.com

Website: www.discoverysilver.com

Qualified Person

Gernot Wober, P.Geo, VP Exploration, Discovery Silver Corp., is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and has reviewed and validated that the information contained in this news release is accurate.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release is not for distribution to United States newswire services or for dissemination in the United States.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

Cautionary Note Regarding Forward-Looking Statements

This news release may include forward-looking statements that are subject to inherent risks and uncertainties. All statements within this news release, other than statements of historical fact, are to be considered forward looking statements. Forward-looking statements including, but not limited to Discovery’s future plans and objectives regarding the Cordero Project and the prospect of further discoveries there, which constitute forward looking information that involve various risks and uncertainties. Although Discovery believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those described in forward-looking statements. Factors that could cause actual results to differ materially from those described in forward-looking statements include fluctuations in market prices, including metal prices, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. Discovery does not assume any obligation to update any forward-looking statements except as required under applicable laws.

APPENDICES

TABLE 1 – PFS Locked Cycle Test Results

| Test Type | Rock Type / Sample Location | Head Grade | Lead Circuit | Zinc Circuit | |||||||||

| Recovery to Concentrate | Concentrate Grade | Recovery to Concentrate | Concentrate Grade | ||||||||||

| Ag | Pb | Zn | AgEq | Ag | Pb | Ag | Pb | Ag | Zn | Ag | Zn | ||

| (g/t) | (%) | (%) | (g/t) | (%) | (%) | (g/t) | (%) | (%) | (%) | (g/t) | (%) | ||

| High-Grade | Breccia | 252 | 3.8 | 2.6 | 462 | 93 | 96 | 4,634 | 73 | 4 | 93 | 219 | 52 |

| Volcanic | 71 | 1.9 | 5.1 | 319 | 91 | 97 | 2,518 | 72 | 6 | 92 | 55 | 57 | |

| Volcanic | 46 | 0.9 | 2.1 | 151 | 86 | 93 | 3,270 | 69 | 8 | 96 | 100 | 56 | |

| Sedimentary | 41 | 0.8 | 1.6 | 128 | 81 | 89 | 2,395 | 53 | 13 | 96 | 182 | 53 | |

| Rock Type Blend | Starter Pit | 37 | 0.6 | 0.6 | 76 | 85 | 92 | 3,516 | 57 | 7 | 89 | 287 | 53 |

| NE Extension | 29 | 0.5 | 0.7 | 70 | 81 | 90 | 3,085 | 61 | 10 | 84 | 249 | 51 | |

| South Corridor | 33 | 0.4 | 0.8 | 76 | 65 | 85 | 2,868 | 44 | 18 | 85 | 446 | 53 | |

| Run of Mine | 33 | 0.5 | 0.8 | 76 | 75 | 89 | 3,643 | 62 | 12 | 81 | 385 | 59 | |

| Low-Grade | Volcanic | 10 | 0.1 | 0.2 | 21 | 26 | 64 | 712 | 19 | 17 | 62 | 550 | 34 |

| Breccia | 30 | 0.3 | 0.1 | 44 | 69 | 87 | 4,277 | 52 | 7 | 64 | 1,042 | 46 | |

| 10% Oxide / 90% Sulphide Blend | Starter Pit | 40 | 0.5 | 0.5 | 76 | 78 | 84 | 3,694 | 57 | 7 | 89 | 321 | 52 |

| NE Extension | 29 | 0.5 | 0.6 | 66 | 78 | 86 | 3,250 | 61 | 9 | 87 | 255 | 54 | |

| South Corridor | 33 | 0.4 | 0.7 | 71 | 65 | 80 | 3,369 | 49 | 16 | 88 | 434 | 52 | |

| Run of Mine | 35 | 0.5 | 0.7 | 74 | 73 | 84 | 3,506 | 54 | 11 | 88 | 335 | 51 | |

FIGURE A – Global Ag Recovery vs Ag Head Grade

FIGURE B – Pb Recovery vs Pb Head Grade

FIGURE C – Zn Recovery vs Zn Head Grade

FIGURE D – PROPOSED PFS PROCESS DESIGN